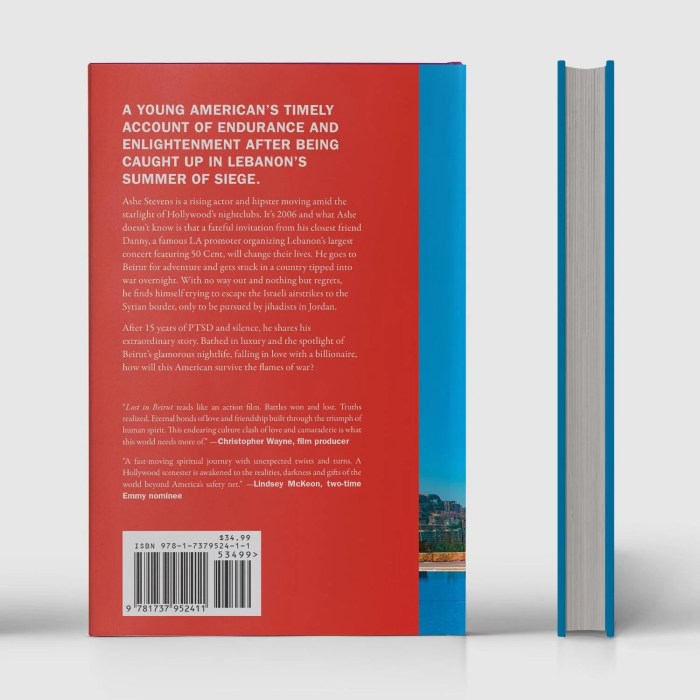

Book How To Be A Super Insurance Broker: A Complete Commercial Insurance Training Guide | Practical Lessons to Win More Clients, Become a Better Negotiator and Supercharge Your Insurance Brokering Skills provides a comprehensive overview of commercial insurance brokering. The book delves into essential aspects, from defining commercial insurance and understanding its importance for businesses to acquiring clients, analyzing policies, and mastering negotiation techniques. It also covers crucial areas like product knowledge, building a strong brokerage practice, and managing risk effectively. The practical lessons and case studies within offer actionable strategies for success in the field.

The book’s structure facilitates a clear progression from fundamental concepts to advanced strategies. It begins with the core principles of commercial insurance and progresses through the stages of client acquisition, policy analysis, and negotiation. The guide culminates with discussions on building a successful brokerage, managing risk, and continuous professional development. A detailed table of contents further enhances the reader’s understanding and facilitates targeted learning.

Introduction to Commercial Insurance Brokering

Commercial insurance protects businesses from financial losses due to various risks. It’s a crucial component of a robust business strategy, safeguarding assets, operations, and reputation. Understanding the nuances of commercial insurance is paramount for businesses of all sizes.

The field of commercial insurance is multifaceted and requires specialized knowledge and skills. A successful commercial insurance broker acts as a vital intermediary, connecting businesses with suitable insurance policies tailored to their specific needs and risk profiles. This expertise is essential for businesses seeking optimal protection and cost-effectiveness.

Definition of Commercial Insurance

Commercial insurance encompasses a wide range of policies designed to protect businesses from financial losses arising from unforeseen events. These policies address risks specific to business operations, such as property damage, liability claims, and employee injuries.

Role of a Commercial Insurance Broker, Book How To Be A Super Insurance Broker: A Complete Commercial Insurance Training Guide | Practical Lessons to Win More Clients, Become a Better Negotiator and Supercharge Your Insurance Brokering Skills

A commercial insurance broker acts as a liaison between businesses and insurance providers. They assess a business’s unique risk factors, needs, and budget to recommend appropriate insurance coverage. Their expertise lies in identifying the most suitable policy options for clients, negotiating favorable terms, and ensuring that the chosen coverage effectively mitigates potential losses. A broker actively advocates for their clients, safeguarding their interests throughout the insurance process.

Importance of Commercial Insurance for Businesses

Commercial insurance is critical for the survival and growth of businesses. It protects against financial ruin from unforeseen events like fires, lawsuits, or natural disasters. Without adequate insurance, businesses risk bankruptcy or significant financial setbacks. Proper insurance also enhances the business’s credibility and attracts investors and partners.

Key Skills Required to Excel as a Commercial Insurance Broker

To excel in commercial insurance brokering, a combination of skills is essential. Strong communication and negotiation abilities are vital for building rapport with clients and securing favorable terms. A thorough understanding of insurance policies, industry regulations, and business risks is also critical. Analytical skills are necessary to evaluate client needs and assess risks accurately.

Comparison of Different Types of Commercial Insurance Policies

| Policy Type | Description | Key Coverage | Example Scenarios |

|---|---|---|---|

| Property Insurance | Covers physical assets owned by the business, including buildings, equipment, and inventory. | Damage or destruction from fire, storms, vandalism, etc. | A factory’s warehouse burns down, and the insurance covers the replacement of equipment and inventory. |

| Liability Insurance | Protects against claims of negligence or harm caused by the business’s operations. | Product liability, premises liability, general liability. | A customer slips and falls in a store, and the liability insurance covers medical expenses and legal fees. |

| Workers’ Compensation Insurance | Provides coverage for medical expenses and lost wages for employees injured on the job. | Medical care, lost income benefits, rehabilitation. | An employee suffers a workplace injury, and the insurance covers their medical expenses and lost wages. |

| Commercial Auto Insurance | Covers vehicles used in business operations, including trucks, vans, and cars. | Accidents, collisions, property damage, injuries. | A delivery truck involved in an accident is covered by the commercial auto insurance. |

Client Acquisition and Relationship Management

Attracting and retaining commercial clients requires a strategic approach that goes beyond simply quoting policies. Building lasting relationships is crucial for long-term success in the competitive commercial insurance market. This section details effective strategies for acquiring new clients, fostering strong relationships, understanding their unique needs, and implementing effective communication protocols.

Effective client acquisition and relationship management are essential for sustained success in the commercial insurance sector. By understanding client needs, tailoring solutions, and nurturing strong relationships, insurance brokers can cultivate a loyal client base and establish a reputation for exceptional service. This approach leads to repeat business, positive referrals, and ultimately, a thriving insurance brokerage.

Attracting New Commercial Clients

Effective strategies for attracting new commercial clients involve a proactive approach beyond simply waiting for inquiries. A comprehensive marketing plan is essential, encompassing both digital and traditional channels. Targeted advertising, networking events, and partnerships with complementary businesses are crucial for expanding reach. Highlighting expertise in specific industry sectors can further attract clients seeking specialized solutions.

Building and Maintaining Strong Client Relationships

Building and maintaining strong client relationships is an ongoing process requiring proactive communication and a commitment to exceeding expectations. Regular communication, both proactive and reactive, builds trust and demonstrates a genuine interest in the client’s business. Personalized service, understanding the client’s unique needs, and proactively anticipating potential challenges can differentiate a brokerage and foster long-term partnerships.

Understanding Client Needs and Expectations

Understanding client needs and expectations is fundamental to providing tailored insurance solutions. This involves a deep understanding of the client’s business operations, risk profiles, and financial objectives. Active listening and thorough questioning are crucial for gathering this information. Gathering data through detailed questionnaires and meetings with key decision-makers will help insurance brokers understand specific risks and identify potential vulnerabilities.

Best Practices for Client Communication

Effective communication is critical for fostering strong client relationships. Understanding various communication preferences and employing appropriate methods is key. This section details best practices in communication to maintain open lines of communication and ensure that clients feel heard and valued.

| Communication Method | Description | When to Use |

|---|---|---|

| Phone Calls | Direct, immediate communication | For urgent matters, sensitive issues, or building rapport. |

| Formal, detailed communication | For policy details, updates, or complex information. | |

| In-Person Meetings | Building rapport, discussing complex issues | For initial consultations, policy reviews, or presenting complex solutions. |

| Online Portals/CRM Systems | Streamlined communication and access to information | For routine updates, policy renewals, or general inquiries. |

| Video Conferencing | Visual interaction for remote clients | For initial consultations, remote policy reviews, or for complex presentations. |

Different Client Segments in the Commercial Insurance Market

The commercial insurance market encompasses diverse client segments with varying needs and risk profiles. Identifying these segments and understanding their specific requirements is vital for tailoring insurance solutions and marketing efforts.

- Small Businesses: These businesses often require cost-effective insurance solutions that address their unique operational needs and risks. Examples include sole proprietorships, partnerships, and small corporations.

- Medium-Sized Enterprises (MSEs): MSEs have more complex needs and risks compared to small businesses. Their insurance solutions often involve a combination of general liability, property insurance, and other specialized coverages. They may also require more in-depth risk assessments.

- Large Corporations: These clients require comprehensive insurance programs that cover extensive operations, complex risks, and potential liabilities. Risk management and mitigation strategies are frequently more elaborate and specialized.

- Specific Industry Sectors: Understanding the unique risks and needs of specific industries, like manufacturing, healthcare, or retail, is vital. Tailoring insurance solutions to those specific needs can result in more competitive pricing and appropriate coverages.

Insurance Policy Analysis and Negotiation

Mastering the art of insurance policy analysis and negotiation is crucial for a successful commercial insurance broker. This involves understanding client needs, reviewing policy options, and effectively negotiating favorable terms. This section will equip you with the skills necessary to excel in these areas, ultimately leading to stronger client relationships and increased profitability.

Analyzing a client’s insurance needs goes beyond simply identifying the type of coverage required. It involves a deep understanding of their business operations, potential risks, and financial goals. This comprehensive approach ensures that the chosen policy aligns perfectly with their specific circumstances.

Analyzing Client Insurance Needs

Thorough client analysis is paramount to securing the most appropriate coverage. This involves gathering comprehensive information about the client’s business operations, including the nature of their work, their assets, and their potential liabilities. A detailed assessment of their risk profile is essential.

- Understanding the client’s business: Review the client’s business model, operations, and industry. Assess their specific risks based on their industry and operational characteristics. For instance, a manufacturing company faces different risks than a retail store. This initial step provides context for the subsequent analysis.

- Identifying potential risks: Conduct a thorough risk assessment, evaluating potential hazards like property damage, liability claims, and financial losses. This could include physical damage to property, product liability claims, or reputational damage from a security breach.

- Assessing financial capacity: Analyze the client’s financial resources and budget to determine their capacity to absorb potential losses. Understanding their financial position helps in determining appropriate coverage limits and deductibles.

- Considering regulatory compliance: Insurance requirements vary based on industry regulations and local laws. Ensure the selected policies comply with all relevant regulations.

Reviewing Insurance Policy Options

Effective policy review involves a methodical approach to evaluate various options available from different insurance providers.

- Comparing policy provisions: Carefully review policy provisions, focusing on coverage limits, exclusions, deductibles, and policy terms. Compare different policy options to identify the best fit for the client’s needs.

- Evaluating policy exclusions: Pay close attention to policy exclusions to understand what risks are not covered. For example, certain policies may exclude coverage for intentional acts or pre-existing conditions.

- Analyzing coverage limits: Understand the coverage limits of each policy option. Ensure the limits adequately protect the client’s assets and liabilities. This is critical in protecting the client’s business from unforeseen events.

- Considering policy terms and conditions: Review policy terms and conditions, including renewal periods, claim procedures, and dispute resolution mechanisms. This will ensure a smooth and efficient process for both the client and the insurance company in case of a claim.

Negotiating Favorable Insurance Terms

Negotiation skills are crucial to secure the best possible terms for your clients.

- Understanding the insurance market: Stay updated on current market trends, pricing, and policy changes. This allows you to negotiate effectively and present the most favorable options to the client.

- Identifying opportunities for cost savings: Look for opportunities to reduce premiums by adjusting coverage limits, deductibles, or policy provisions. This involves exploring various policy options to find the best balance between coverage and cost.

- Presenting a compelling case: Highlight the client’s specific needs and risks, and demonstrate how the proposed policy options address those needs. Clearly articulate the benefits of the proposed policy options.

- Building rapport with insurers: Establish strong relationships with insurance providers to gain insights into pricing and policy options. Building rapport and trust will help you to negotiate more effectively.

Common Insurance Policy Clauses and Implications

| Clause | Implications |

|---|---|

| Coverage Limits | Defines the maximum amount the insurer will pay for a covered loss. |

| Exclusions | Specifies risks or events not covered by the policy. |

| Deductibles | Amount the insured must pay before the insurer pays a claim. |

| Policy Period | Specifies the duration of coverage. |

| Subrogation Rights | Insurer’s right to recover losses from a third party. |

Identifying and Managing Risk Factors

Understanding and mitigating risk is crucial for protecting clients.

- Identifying potential risks: Analyze client operations and identify potential threats, such as property damage, liability claims, and financial losses. This involves evaluating the client’s specific business activities and the potential for different types of risks.

- Implementing risk mitigation strategies: Develop and implement strategies to minimize risks, such as safety procedures, security measures, and preventative maintenance. These strategies can include investing in security systems, implementing safety training programs, or establishing clear emergency protocols.

- Monitoring and evaluating risk: Regularly monitor and evaluate risk factors to ensure the effectiveness of mitigation strategies. This continuous assessment is crucial for maintaining a proactive approach to risk management.

Insurance Product Knowledge and Expertise

Mastering commercial insurance products is crucial for success as a broker. This involves a deep understanding of various policy types, effective communication of complex concepts, staying informed about industry trends, and adept analysis of policy wording. A thorough knowledge base allows brokers to effectively advise clients, negotiate favorable terms, and ultimately build stronger relationships.

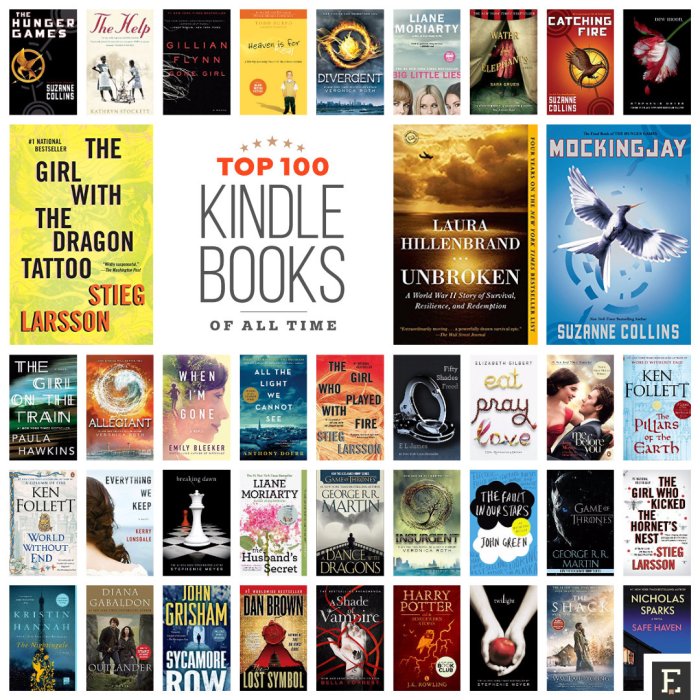

Different Types of Commercial Insurance Products

Commercial insurance caters to a wide range of businesses, each with unique needs. This necessitates a familiarity with various products, including but not limited to property insurance, liability insurance, workers’ compensation, and business interruption insurance. Understanding the nuances of each product is essential for tailoring appropriate coverage. Specialized products such as professional liability insurance, cyber liability insurance, and surety bonds further enhance the scope of coverage options.

Effective Communication of Complex Insurance Concepts

Clearly articulating complex insurance concepts to clients is paramount. Employing straightforward language, avoiding jargon, and providing real-world examples can significantly improve client comprehension. Analogies and metaphors can be effective tools for conveying abstract insurance principles. For instance, explaining the concept of deductibles by comparing them to a co-pay in healthcare or explaining the concept of coverage limits by referring to a budget.

Staying Updated on Industry Trends and Regulations

The insurance industry is dynamic, constantly evolving with new trends and regulatory changes. Staying abreast of these developments is vital for providing clients with up-to-date and accurate advice. This involves regularly reviewing industry publications, attending relevant seminars, and engaging with professional organizations. For example, changes in flood zones, new environmental regulations, or updated cybersecurity standards can all affect commercial insurance policies.

Understanding Policy Wording and Terms

Insurance policies are complex legal documents. A thorough understanding of policy wording and terms is critical for accurate interpretation and application. Brokers must be proficient in identifying key clauses, including definitions, exclusions, and limitations. This process should involve careful scrutiny of each section to ensure proper coverage. Brevity, clarity, and precision are essential in presenting policy information to clients.

Common Insurance Policy Exclusions and Their Significance

Insurance policies often contain exclusions, which are specific circumstances or situations not covered by the policy. Recognizing these exclusions is crucial for providing clients with realistic expectations. Understanding the rationale behind exclusions is equally important. This enables brokers to proactively discuss potential risks and recommend appropriate coverage. The table below illustrates some common exclusions and their implications.

| Exclusion | Significance |

|---|---|

| Earthquake damage | Earthquake damage is typically excluded from standard property policies, and often requires a rider or separate policy. |

| War or Terrorism | War or acts of terrorism are frequently excluded, requiring specialized coverage. |

| Pre-existing conditions | Pre-existing conditions, especially in professional liability insurance, are commonly excluded. |

| Employee dishonesty | Employee dishonesty is often excluded, requiring a specific rider. |

| Nuclear events | Nuclear events are almost always excluded, requiring a separate policy. |

Building a Strong Brokerage Practice

Establishing a successful commercial insurance brokerage requires more than just expertise in policy analysis. A robust practice hinges on a strong brand identity, effective marketing strategies, streamlined internal processes, and a commitment to profitability and growth. This section delves into these crucial components, providing actionable steps for brokers to build and sustain a thriving business.

Building a strong brokerage practice involves more than just selling policies; it’s about cultivating a recognizable brand and building lasting client relationships. This approach differentiates the brokerage from competitors and fosters trust, ultimately leading to sustainable growth.

Professional Brand Identity

A strong brand identity is crucial for establishing credibility and attracting clients. This involves developing a unique brand name, logo, and visual style that reflects the brokerage’s values and expertise. A professional website and marketing materials further reinforce the brand, showcasing the brokerage’s capabilities and commitment to client service. Consistent branding across all platforms, from business cards to social media profiles, ensures a cohesive and memorable image.

Marketing and Advertising Strategies

Effective marketing and advertising are essential for reaching potential clients and generating leads. This involves identifying the target market and tailoring messaging to resonate with their needs. Utilizing a mix of online and offline channels, such as industry events, targeted advertising campaigns, and content marketing, is vital. Networking and building relationships with key decision-makers within target industries are also important components of a successful marketing strategy.

Developing Internal Systems and Processes

Streamlined internal systems and processes are critical for efficiency and profitability. This includes establishing clear procedures for handling client inquiries, processing claims, and managing accounts. Implementing robust technology solutions can significantly enhance operational efficiency and improve communication with clients. Training and development for staff members ensure a consistent level of service and expertise.

Effective Marketing Channels for Insurance Brokers

A comprehensive marketing strategy utilizes diverse channels to reach a broad audience. This multifaceted approach leverages both traditional and modern methods.

| Marketing Channel | Description | Effectiveness |

|---|---|---|

| Industry Events and Conferences | Networking and showcasing expertise to potential clients. | High, particularly for building relationships. |

| Targeted Online Advertising (e.g., LinkedIn, Google Ads) | Reaching specific demographics and industries with tailored messages. | High, with potential for high return on investment. |

| Content Marketing (e.g., Blog posts, Case Studies) | Positioning the brokerage as a thought leader and demonstrating expertise. | Medium to High, builds credibility over time. |

| Social Media Marketing (e.g., LinkedIn, Twitter) | Engaging with potential clients and building brand awareness. | Medium, depends on engagement strategy. |

| Email Marketing | Nurturing leads and keeping clients informed about services. | Medium, if segmented and targeted effectively. |

| Referral Programs | Leveraging existing client relationships to generate new business. | High, based on client satisfaction. |

Profitability and Growth Strategies

Sustainable profitability and growth require a strategic approach. This includes analyzing market trends, understanding client needs, and adapting services accordingly. Regularly evaluating performance metrics, such as client acquisition costs and policy premiums, allows for adjustments to optimize profitability. Investing in employee training and development ensures a skilled workforce capable of providing high-quality service. Developing unique value propositions that set the brokerage apart from competitors is vital for attracting and retaining clients.

Client Case Studies and Success Stories

Client case studies are invaluable tools for demonstrating the value of commercial insurance brokerage services. They showcase the practical application of insurance solutions, highlighting successful outcomes and the positive impact on clients’ businesses. Understanding how brokers have navigated complex situations and achieved positive results provides valuable insight and inspiration for future engagements.

Effective case studies effectively communicate the complexities of commercial insurance to clients, showcasing how the broker acted as a strategic partner. They offer compelling evidence of the value proposition, empowering clients to trust their broker’s expertise.

Successful Client Case Study: Protecting a Growing Technology Startup

A burgeoning technology startup, “InnovateTech,” faced significant risks associated with its rapid expansion. They were struggling to secure adequate liability coverage, property protection, and cyber insurance tailored to their unique needs. Their existing insurance policies were inadequate and lacked the specific provisions required to address potential issues arising from intellectual property rights, data breaches, and potential lawsuits.

InnovateTech’s broker, recognizing the growing complexity of their risks, developed a comprehensive insurance strategy. The broker analyzed InnovateTech’s operations, identified vulnerabilities, and proactively sought specialized coverage to address potential liabilities. The solution involved a customized policy package incorporating several unique elements: a high-limit general liability policy, a specialized cyber insurance policy addressing data breaches and privacy violations, and a robust intellectual property protection rider.

The results were demonstrably positive. InnovateTech experienced a significant reduction in risk exposure and achieved greater peace of mind. The tailored insurance package allowed them to focus on innovation and growth, free from the constant worry of potential financial losses. The broker’s proactive approach and personalized solutions strengthened the client relationship and cemented InnovateTech’s trust.

Effective Communication of Complex Insurance Solutions

Clear and concise communication is paramount when explaining complex insurance solutions to clients. Using analogies and relatable examples helps clients grasp the nuances of coverage and exclusions. Avoid jargon and technical terms, opting for plain language that clients can easily understand. For example, instead of saying “aggregate limits,” explain the maximum amount the insurer will pay for all claims in a specific policy period. Illustrating concepts with visual aids, such as charts and diagrams, can further enhance understanding.

Illustrative Examples of Overcoming Negotiation Challenges

Negotiating with insurers to secure favorable terms and conditions requires adept communication and a thorough understanding of insurance policies. A key strategy is to present a well-prepared case that demonstrates the client’s specific needs and risk profile. If the initial offer doesn’t meet the client’s requirements, propose alternative solutions and explore various policy options to find a mutually beneficial agreement. Using data to support claims of value and risk is critical in achieving successful negotiations.

Key Factors Contributing to a Successful Client Outcome

| Factor | Description |

|---|---|

| Client Needs Assessment | Thorough understanding of the client’s business operations, risks, and financial goals. |

| Customized Solutions | Tailoring insurance policies to address specific needs and vulnerabilities. |

| Proactive Risk Management | Identifying potential risks and proactively seeking solutions to mitigate them. |

| Effective Communication | Clearly explaining complex insurance concepts to clients in a manner they understand. |

| Strong Negotiation Skills | Successfully advocating for clients’ interests during policy negotiations. |

Continuous Learning and Professional Development

The insurance landscape is constantly evolving. Staying abreast of changes in regulations, emerging risks, and new insurance products is crucial for brokers. Continuous professional development through training courses, industry conferences, and mentorship programs ensures brokers maintain their expertise and deliver the best possible service to clients.

Professional Development and Best Practices

Continuous professional development is crucial for insurance brokers to stay ahead of evolving regulations, market trends, and client needs. Staying updated on industry best practices and maintaining high ethical standards are essential for building a successful and reputable brokerage. This section will explore the key elements of professional development, including certifications, industry engagement, and ethical considerations.

Importance of Professional Certifications and Designations

Professional certifications and designations demonstrate a broker’s commitment to excellence and expertise. They validate their knowledge and skills, enhancing credibility with clients and potential clients. Insurance brokers who hold recognized certifications often command higher fees and have a competitive edge in the market. These credentials can also indicate a broker’s understanding of specific areas of expertise, such as property & casualty, life insurance, or commercial insurance. For example, the Chartered Property Casualty Underwriter (CPCU) designation signifies a high level of expertise in property and casualty insurance.

Value of Attending Industry Conferences and Workshops

Industry conferences and workshops provide invaluable opportunities for brokers to network with peers, learn from industry leaders, and gain access to the latest information and best practices. These events often feature presentations, seminars, and networking opportunities, fostering professional growth and knowledge sharing. Attending conferences allows brokers to stay informed about current trends, regulatory changes, and emerging technologies. For instance, the annual meetings of the National Association of Insurance Commissioners (NAIC) offer updates on legislative and regulatory developments.

Leveraging Industry Resources Effectively

Insurance brokers can effectively leverage industry resources to improve their skills and stay informed. These resources can include industry publications, online courses, and professional organizations. Staying informed through industry publications like Insurance Journal and various online training programs helps keep brokers abreast of changing regulations and emerging trends. Joining professional organizations such as the American Insurance Association (AIA) provides access to valuable resources, networking opportunities, and advocacy efforts.

Maintaining Ethical Standards in Brokerage Practices

Maintaining ethical standards is paramount for insurance brokers. It builds trust with clients and fosters a reputation for integrity. Adhering to the principles of honesty, transparency, and fairness in all dealings is essential. Brokers must avoid conflicts of interest and ensure they act in the best interests of their clients. This includes providing unbiased advice and disclosing all relevant information to clients. A code of ethics provides a framework for brokers to guide their actions and decision-making.

Maintaining Client Confidentiality

Client confidentiality is of utmost importance in insurance brokerage. Breaching client confidentiality can result in significant legal and reputational damage. Strict adherence to privacy regulations and the establishment of clear protocols are essential to maintain client trust. Brokers must safeguard sensitive client information, including financial details, personal information, and policy specifics. Using secure systems for storing and transmitting client data, along with strict adherence to confidentiality agreements, is critical to protecting client privacy. This practice helps build long-term relationships and fosters client loyalty.

Risk Management and Compliance: Book How To Be A Super Insurance Broker: A Complete Commercial Insurance Training Guide | Practical Lessons To Win More Clients, Become A Better Negotiator And Supercharge Your Insurance Brokering Skills

Effective risk management is crucial for commercial insurance brokers. Understanding and mitigating potential risks associated with client operations is paramount to securing profitable and sustainable client relationships, while also adhering to the stringent compliance standards within the insurance industry. Proactive risk assessment and adherence to regulatory guidelines are essential for avoiding costly errors and maintaining a strong reputation.

Importance of Risk Assessment for Commercial Clients

Risk assessment for commercial clients is not simply a compliance exercise; it’s a proactive strategy to identify potential financial vulnerabilities and operational weaknesses. A thorough assessment allows brokers to tailor insurance policies to precisely address the client’s specific risks, reducing the likelihood of claims and optimizing coverage. This proactive approach fosters stronger client relationships by demonstrating a commitment to their financial well-being. It also allows the broker to identify potential red flags that might indicate higher risk, enabling them to make informed decisions about accepting or declining the client.

Compliance Requirements for Insurance Brokers

Insurance brokers are subject to a complex web of regulations designed to protect policyholders and maintain the integrity of the industry. These regulations vary by jurisdiction and often encompass licensing requirements, ethical conduct standards, and reporting obligations. Adherence to these regulations is not merely a matter of avoiding penalties; it’s a cornerstone of building and maintaining trust with clients and regulators. This involves maintaining accurate records, adhering to disclosure obligations, and staying updated on any changes to industry regulations.

Implications of Regulatory Changes in the Insurance Industry

Regulatory changes within the insurance industry can have significant implications for brokers. New laws, revisions to existing statutes, and adjustments to reporting requirements necessitate continuous learning and adaptation. Staying informed about these changes is critical for brokers to maintain compliance and ensure that their practices remain current with the latest regulations. Failure to adapt to regulatory changes can lead to substantial financial penalties and reputational damage.

Common Compliance Issues and Solutions

Maintaining compliance requires proactive vigilance. Below is a table highlighting common compliance issues and effective solutions:

| Compliance Issue | Potential Solution |

|---|---|

| Inadequate risk assessment | Implement a standardized risk assessment process for all clients, encompassing thorough due diligence and a comprehensive review of operations and financial records. |

| Failure to disclose material information | Establish clear and consistent disclosure procedures, ensuring that all relevant information is communicated transparently to clients and regulators. |

| Non-compliance with licensing requirements | Regularly review and update licensing status to ensure continued compliance with all relevant state and federal regulations. |

| Lack of proper documentation | Maintain comprehensive records of all client interactions, transactions, and regulatory filings, ensuring complete and accurate documentation. |

| Inadequate training on regulatory changes | Engage in continuous professional development, including training sessions and workshops, to stay informed about changes to industry regulations. |

Methods for Identifying Potential Risks in Client Situations

Effective risk identification requires a multifaceted approach, encompassing a range of techniques and perspectives. Understanding the client’s business model, financial position, and operational procedures are fundamental elements of this process. Brokers should engage in detailed discussions with clients to ascertain potential risks, including financial instability, regulatory violations, and environmental hazards. This also involves seeking professional advice from other relevant experts, such as legal counsel or industry specialists.

Outcome Summary

In conclusion, Book How To Be A Super Insurance Broker: A Complete Commercial Insurance Training Guide provides a practical and comprehensive guide for aspiring and experienced commercial insurance brokers. The book offers a practical approach to understanding the complexities of the industry, from acquiring clients to mastering negotiations and managing risk. The emphasis on practical applications and client case studies equips readers with the knowledge and skills needed to excel in the field and establish a successful insurance brokerage practice. The book’s focus on continuous learning and professional development ensures readers stay abreast of industry trends and best practices.

Questions Often Asked

What specific types of commercial insurance policies are covered in the book?

The book covers a variety of commercial insurance policies, including property, liability, and workers’ compensation. A comparative table is provided to illustrate the key differences and applications of each policy type.

How does the book help me to effectively communicate complex insurance concepts to clients?

The book provides strategies for effectively communicating complex insurance concepts to clients. It emphasizes the importance of clear and concise language, tailoring the explanation to the client’s specific understanding, and utilizing illustrative examples.

What are the key factors that contribute to a successful client outcome, as discussed in the case studies?

The book highlights key factors such as clear communication, understanding client needs, and building strong relationships. A table Artikels these factors and their importance in achieving favorable outcomes for both the broker and the client.

How does the book help in maintaining profitability and growth of the insurance brokerage?

The book discusses various business strategies that promote profitability and growth, including effective marketing and client acquisition strategies, as well as the importance of building strong internal systems and processes.